If you are a high-income earner, it is reasonable to implement tax minimisation strategies. Effective tax planning with a qualified accountant/tax specialist can help you to do that.

Tax planning benefits

Effective tax planning can help you:

- to legally minimise your tax.

- have more money available to build your individual wealth.

- to avoid any penalties for tax evasion.

- maximise the transfer of inter-generational wealth.

The top Tax Planning strategies for High-Income Employees/Self-employed

In general, you should never spend more than you earn. This means that if your annual income is $100,000, your spending should be even less including your mortgage, car payments, and other expense.

Using credit cards excessively, for example, can lead to financial trouble and personal stress. Borrowing, on the other hand, can be fruitful if used on an investment that will increase your wealth in the future (e.g. purchasing a property).

Outlined below are a range of tax planning strategies that we use with our clients to assist them in minimising their tax payable.

1. Maximising your allowable tax deductions

Tax deductions are allowable expenses that reduce your taxable income (and therefore your tax liability).

One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. Currently, taxpayers can make super contributions up to $27,500 (this is known as the concessional contributions cap) including your employer super contributions.

So, if your gross salary is $100,000, your employer will pay 10 per cent towards your super which is $10,000, which implies that you can sacrifice up to $17,500 and reduce your tax liability.

Another important tax-deductible expense is income protection insurance if paid from your own savings and not from your super fund. This insurance can help to protect your assets and lifestyle if you are ever unable to work for some time.

2. Reducing your capital gains tax (CGT) liability

One way to do this is to strategically time the sale of the asset to take advantage of tax concessions (e.g. there is a 50 per cent CGT discount on assets held for more than 12 months). If you are selling a property, it is important to note that CGT is payable in the year that you sign a contract, not when the settlement occurs.

3. Buying assets in your partner’s name

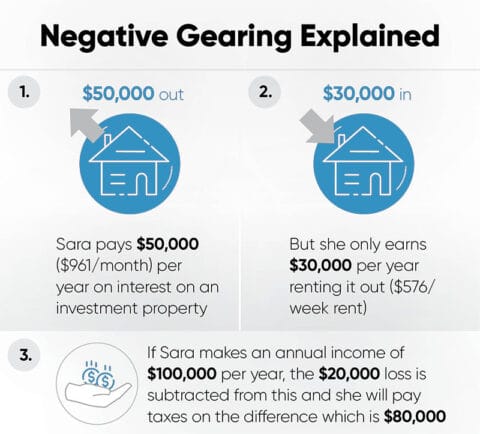

For this strategy to be effective, your partner must have a lower marginal tax rate than you do. In this way, the net income from the investment will be taxed at a lower tax rate. If the investment is negatively geared, then the ownership of the asset may be more tax effective in the higher income earners’ name as they will be able to use the amount of the negative gear to reduce their taxable income and therefore tax liability.

4. Setting up a discretionary trust to distribute business/investment income

This allows you to distribute the income to trust beneficiaries with lower marginal tax rates, therefore reducing your personal tax liability.

5. Salary sacrificing into superannuation

Salary sacrificing into super involves forgoing some of your pre-tax salary/wages and putting it into super instead. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 per cent. This rate is lower than the lowest marginal tax rate, therefore you will save tax by doing it. A good calculator to work this out is provided by AMP in this link

6. Timing is key to reducing your tax liabilities

Income tax years start on 1st July and end on 30th June. Planning your income and expenses within this period is important for reducing your taxes. Individuals prepare their tax return on a cash basis that is when they receive income or pay an expense. So, let’s say that you are aware early in the year that your total income from all sources for the year will be very high, and you wish to invest in a term deposit, then it is wise to defer the maturity of the term deposit by ensuring that it will be after 30 June (deferring it to the following year).

7. Negatively Gear an Investment Property

High-income earners who have positively geared properties should consider selling them off and buying another that will provide a negative result with the potential to increase in value or invest the money elsewhere. Positively geared properties are not the best idea since they will increase your tax liabilities.

8. Private Health Insurance

Having private health insurance will prevent you from paying the Medicare levy surcharge. You also may get free GP visits if you buy extra coverage in your policy and choose a general practitioner that is a provider of your health fund. This will also give you free ambulance services, and you can always choose the doctor that you prefer.

Medicare Levy Surcharge is based on your income as displayed below.

| Singles | ≤$90,000 | $90,001-$105,000 | $105,001-$140,000 | ≥$140,000 |

| Families | ≤$180,000 | $180,001-$210,000 | $210,001-$280,000 | ≥$280,000 |

| Surcharge | 0% | 1% | 1.25% | 1.50% |

Normally when we advise customers to do this we suggest starting at PrivateHealt.gov.au to compare policies.

9. Insurance

Insurance is an area that many people consider to be a waste of money especially if no harm can be claimed. No one wants to be harmed or disadvantaged but it can happen, and to be protected you will have to transfer your own risks to another party for a premium that can be tax deductible. This is great because it will give you peace of mind, which is very important to your general health.

10. Use your Franking Credits wisely to reduce taxes

Use of Franking Credits in your tax planning can save you tax. This is achieved by utilising the tax paid by the company, which is passed on to the shareholder when a Franked Dividend is paid. Franking credits can reduce the income tax paid on dividends, or potentially be received as a tax refund.

How we can help

Taxation rules are complicated and change frequently. You should consult an accountant before making any changes to your financial situation.

Our team can help to plan and implement legal tax minimisation strategies. We provide tax planning services for both individuals and businesses. Contact us today to discuss how we can help you and/or your business.

Disclaimer: Every effort was made to ensure that the information provided is accurate. However, no responsibility is accepted for any error, or for any loss arising from the use of the above information.